Essential Insights at a Glance

- Compared to old-school magnetic stripe cards, chip cards offer a tougher defense against skimming—but they’re not completely foolproof.

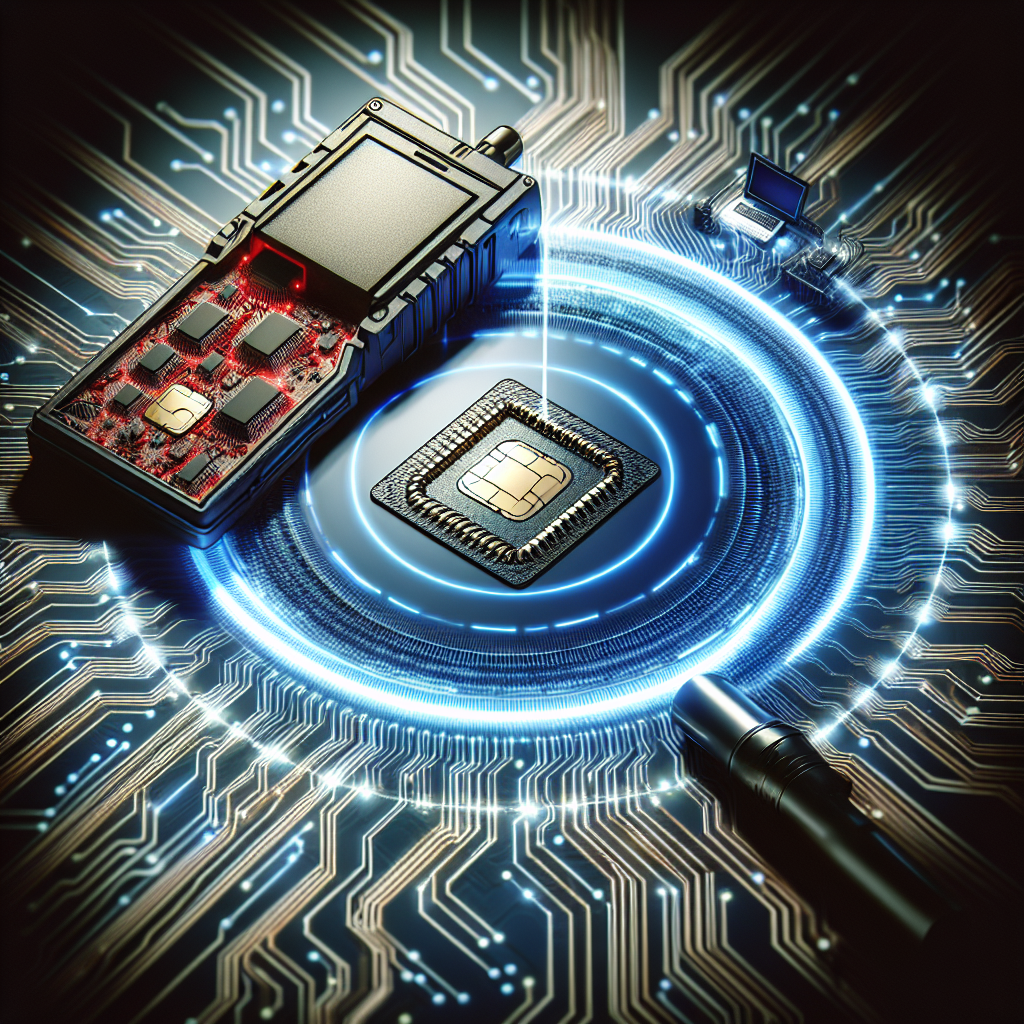

- Cyber crooks have devised a crafty trick called shimming to snatch card data even from chip-enabled cards.

- By exploiting shimming, scammers can forge counterfeit credit cards armed with your stolen details.

From Magnetic Stripes to Chip Cards: The Evolution Doesn’t Mean Immunity

Magnetic stripe cards are steadily fading into obsolescence here in the U.S. now that chip cards rule the scene. But does their rise signal the end of your troubles at retail counters and fuel pumps? Not quite. Cunning fraudsters still deploy discreet gadgets to “skim” your card details the moment you slide or tap your card into payment terminals. This pilfered data is later harvested and used to fabricate counterfeit credit cards, enabling unauthorized charges that hit your account.

Chip Cards Aren’t Invincible: The Hidden Threat of Shimming

While chip cards boast enhanced security features that far outclass magnetic stripes, their defenses aren’t airtight. The shady practice known as “shimming” compromises this layer of protection.

How Shimming Undermines Chip Card Security

Chip cards earn their reputation for safety by generating unique tokens for every single transaction, unlike static magnetic stripe data. This dynamic encryption makes stolen info from chip payments generally useless for repeat fraud. However, shimming flips this advantage on its head. Perpetrators slip a slender device—referred to as a “shim”—deep inside the card slot of ATMs or point-of-sale readers. This stealthy add-on houses a tiny microchip and flash memory, quietly harvesting your card data as it’s read.

Unlike chip-generated tokens designed to expire instantly, the data siphoned by these shims remains intact and can be extracted later to authorize additional fraudulent purchases or withdrawals.

Behind the Scenes: What Criminals Do With Shimmed Data

Once recovered, the shim holds treasure troves of card info that criminals imprint onto fake magnetic stripe cards. These shadow duplicates can be swiped just like the real ones. Because genuine chip cards often carry a magnetic stripe as a fallback option, using forged magstripe cards arouses less suspicion and slips through many payment systems unnoticed.

Numbers Speak: Fraud Landscape with Chip Cards

According to recent studies, chip card fraud in the U.S. has dropped by around 80% since their widespread adoption, yet skimming-related fraud still accounts for a significant share of losses at unattended payment terminals, such as gas pumps and ATMs. Experts warn shimming attacks, though less frequent than traditional skimming, are rising steadily, signaling a need for ongoing vigilance.

Guarding Yourself Against Shimming and Card Theft

Arm yourself with these practical strategies to keep your card details under lock and key:

- Go Contactless Whenever Possible: Tap-and-go payments reduce physical card interactions, lowering exposure to skimmers. Contactless methods often come with zero-liability protection if you report suspicious charges within 30 days.

- Use Secure Payment Terminals: Opt for retailers and ATMs located in well-lit, monitored areas where tampering is less likely.

- Monitor Your Statements Religiously: Spot suspicious activity early by reviewing transactions frequently and alerting your card issuer immediately if something looks off.

- Leverage Issuer Protections: Card companies can freeze compromised accounts and issue replacement cards swiftly, curbing fraudulent damage.

Resources for Victims of Card Fraud

The Federal Trade Commission offers dedicated support channels for anyone grappling with credit card fraud, guiding through recovery steps and reporting mechanisms.

Final Thoughts: Chip Cards Are Safer, Not Invincible

Though chip-and-PIN technology marks a giant leap beyond magnetic stripes in fighting fraud, the threat of skimming and shimming lingers. Your vigilance remains your best defense. Keep an eye on your card’s usage, understand emerging scams, and take swift action if your information falls prey to fraudsters.